Planning for Gigabit Delivery consultation response

Background

On December 22, 2020, the Department for Digital, Culture, Media & Sport (DCMS) published “Planning for Gigabit Delivery in 2021” for consultation. The Department asked for input from local and devolved government and telecoms providers to help shape the best use of public subsidy to achieve the Government’s minimum of 85% gigabit-capable coverage for the UK by 2025.

The Government’s £5bn funding for the overall project would be invested in tranches over a period of time. Digital Minister Matt Warman explained: “The judgment of industry and the Government is that the initial phasing of the spending reflects the maximum that can be delivered in the period up to 2025, but we will continue to work with industry to accelerate that as much as possible.”

Central to the Government’s approach would be a mix of regional contracts to drive competition among larger network providers and give the supply chain sufficient certainty to scale up and smaller contracts to stimulate competition for smaller network providers and drive innovative solutions. All contracts would be managed centrally by the Government’s Building Digital UK (BDUK) agency.

BDUK would continue to work with Local Authorities to support communities and SMEs through gigabit vouchers, providing access to better broadband to many more of the hardest-to-reach communities in rural areas across the UK.

In “Planning for Gigabit Delivery in 2021”, DCMS asked for views on a range of topics including:

• Proposals for small area procurements and when should they start.

• The size of proposed procurement areas and how they had been constructed.

• How to make the procurements attractive to the market.

• Where are vouchers a better way to achieve delivery?

Accompanying the consultation document were high-level maps of draft large procurement areas and indicative small procurement areas.

Planning for Gigabit Delivery in 2021 – CDS consultation Response

1 Please provide feedback on the proposed large procurement areas and if proposing any changes provide accompanying rationale.

a. Are the boundaries in the right place?

b. Are the areas the right size – would smaller be better?

CDS response:

In absence of exact boundaries it is difficult to respond precisely. There are two polygons that appear to be in, or partly in the CDS area. One is South of Bristol, the other in South and West Devon, overlapping into Cornwall. The data behind this needs to be made clear, to understand the gaps in the gigabit capable coverage, the scale and scope of which will vary any large procurement boundary BDUK decide on.

What is also a high priority issue to CDS is the map on page 22, (figure 6). The planned gigabit coverage, assuming this is the 80% BDUK believe the market will deliver, does require validation for areas not chosen for Large or Small procurements. Our analysis would indicate the areas identified as likely to be delivered commercially is nowhere near accurate. It is possible that significant areas within the shaded areas lack gigabit capability, as most commercial deployments are not contiguous. Openreach have reported to CDS a 75% coverage by exchange area as “reasonable” for our geography.

Alternative network operators will leave non-cost-effective premises and areas out of their financed proposals too. In addition, it would appear the 80% does not consider the significant public-private investment that has been and is set to occur within our region.

Notably in North Devon and Torridge with over 6k non-contiguous, NGA White premises set to be served via our Phase 2 Lot 4 Contract held with Airband. We also have our 6 new full fibre contracts set to serve over 57k NGA White premises over a significant proportion of the CDS geography.

a. Are the boundaries in the right place?

South of Bristol. An established Alternative Network operator (Truespeed) has been building full-fibre in the rural environments of this area for 4 years. They have commercial plans currently awaiting finance backing for more than 150k full-fibre premises. They have also signed two full-fibre contracts with CDS for a total of 17k NGA White premises (targeted in the design to follow on from this commercial rollout).

A large procurement in this area poses a significant risk to both Truespeed’s commercial rollout and the two contracts CDS has recently signed with them. Conversely, the opposite is also true, this commercial rollout and CDS contracts cause a VFM risk to the large procurement. The intended timescales therefore are critical to understand if the area should proceed.

CDS has also signed an additional full-fibre contract with Airband that intersects with the proposed South Bristol large procurement area. This

contract is set to cover 12k NGA White premises, and once again the large-scale procurement poses a significant risk to the commercial viability of such plans.

West & South Devon, including part of Dartmoor. CDS has recently signed a further full-fibre contract with Airband for both these areas (but not Dartmoor), set to deliver to 14k NGA White non-contiguous premises. This proposal therefore poses a significant risk to these contracts. Conversely the opposite is also true, these contracts would cause a VFM risk to the large procurement. As above, the intended timescales are therefore critical to understand if the area should proceed.

b. Are the areas the right size – would smaller be better?

Compensating for the granularity of data issue, the build of gigabit cable premises in these areas looks to be in order of 200k for South of Bristol and 50k premises for West & South Devon. These are certainly large contracts for full fibre infrastructure. Given more accurate data, further qualitative comments could be made, however these are larger than CDS’s Lots for these areas, however these were for NGA white build only. Rurality type is also a factor in determining the size of a lot.

2 Please provide specific proposals for small area procurement bundles, including rationale. Are there smaller areas of the right characteristic (or right size, including a blend of more expensive and cheaper premises) which you would feel would be suitable for DPS procurements?

a. When would you ideally like these procurements to start?

CDS response:

In absence of exact boundaries it is difficult to respond precisely. There is clearly a significant risk for these small procurement areas to overlap with CDS contracts, and therefore it is essential that detail behind the boundaries and underlying premises are made clear. The comments on the assessed commercial coverage above are also relevant to the gaps proposed to be left in the programme of small lots, these clearly need

to be verified with CDS and the OMR process prior to agreement to proceed.

Given clarity on the coverage, the next risk CDS has identified is in the business case of the CDS gap funded projects with the potential for a rural operator to overbuild. These procurements could also undermine commercial investments operators might have.

Issues for a detailed analysis between the organisation is as follows:

• How to overlap with Public contracts, coverage and timewise?

• Will small procurement areas undermine commercial business case for existing suppliers.

• Handling conflicting Timelines, to determine de-scope opportunities and the logical steps to take to gain agreement with parties.

• Conflicting priorities on resourcing, reducing availability from contracts in progress.

• Conflicting with Commercial Build, both at business case and in delivery.

• Overlapping coverage between NGA contracts interspersed coverage against small procurement areas with full coverage.

In terms of when would we like the procurements to start – assuming there is no overlap intended with our live contracts delivering gigabit capable solutions, we would say quickly to support our economy and communities. We do also see competition on labour within the civils

market, and bid / delivery capacity within our current contracted supplier’s areas of concern.

Alternatively, the live contracts have scope to be added to through the national gigabit programme funds and which may make be a better option to consider to extend reach and accelerate delivery rather than running new bids through the DPS.

3 Please provide views on how we have constructed the example small (DPS) procurement areas in annex A, including the way we have selected an intervention area and the use of MSOA/LSOA boundaries.

a. How can we make these bundles as attractive as possible to the market?

CDS Response:

We don’t have the detail to understand what exactly is included in terms of the underlying premises within the high-level maps of small procurement areas identified, which given the unique nature of the CDS area, is particularly problematic when it comes to us being able to respond in a meaningful way to this question.

We believe CDS is quite unique in having such significant numbers of ongoing Phase 2 Superfast contracts (many of which only having started this year; all delivering full fibre to around 60k NGA White premises). In addition to this, all of these contracts have a sizeable commercial delivery supporting them, which in some cases runs in to 100k+ full fibre premises in NGA grey and black areas (not shown on the below map). Hence it is not possible to respond to this question without your proposed premises level detail.

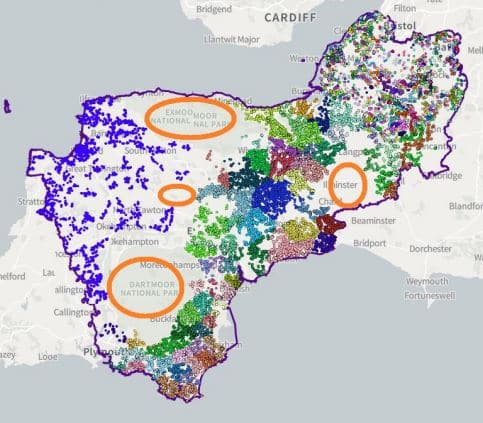

The below map shows the distribution of just the contracted 60k NGA white premises. It is clear therefore that our coverage is widespread, and it is not easy to identify areas across the patch that don’t stand to overlap/compete with our plans!

There are, however, obvious gaps in CDS’s full-fibre plans (as highlighted by the orange circles). These would seem obvious areas for small scale procurements, being near to existing altnet networks, without risking competing and undermining our own interventions. The caveat to this statement is however, that we are concerned the addition of such small-scale procurement areas in our patch, may put additional scale-up pressure on altnets who are already having to scale up massively to be able to deliver on the six contracts and coverage shown on the map below. We certainly wouldn’t want such additional activity, which no doubt altnets will feel obliged to bid for, being the straw that breaks the camel’s back!

We would also make the point that MSOA and LSOA boundaries are arbitrary and not related to any nearby infrastructure or network topology. It would seem far more logical in our opinion, given the unique nature of CDS and it’s significant Phase 2 Full-fibre contracts, to work with us going forward to identify areas within the orange zones of the above map.

4 Where do you feel vouchers are a better way to achieve delivery? Plese explain the rationale for your answer and whether you think there are strategic improvements we could make to the scheme.

CDS Response:

CDS is very supportive of top up voucher schemes, as it is highly likely that gaps in coverage will be created by the Large and Small Area Procurement strategy, due to the varying cost effectiveness within communities.

Clearly a proactive infill approach, resident-led but supported by CDS, will in principle provide the opportunity for their requirements to be served in a strategic way. CDS is in the process of considering an approach to co-fund community voucher projects, at scale, to address this high unit cost market segment in a way that co-ordinates with our live superfast contracts, commercial build and the LSAP strategy. This approach will build on lessons learnt from the CDS Community Challenge Programme over the last two years, especially around solutions to some of the barriers to take-up of the RGVS.

It is worth noting that two District Councils in Devon are currently recruiting to an F/T role to support communities not covered by other contracts to achieve their own network solutions through vouchers. This is a welcome development which is being watched with keen interest by other local authorities and which raises questions around the potential benefit of securing revenue funding to expand this approach across Local Bodies.

Greater clarity around (and perhaps proposals for the regulation of) the relationship between community projects funded through vouchers and parallel USO funded schemes would help ensure that partial community USO initiatives do not render wider community schemes unviable in future. Further information from recent BDUK demand aggregation and supplier brokerage pilots would also help inform our thinking.